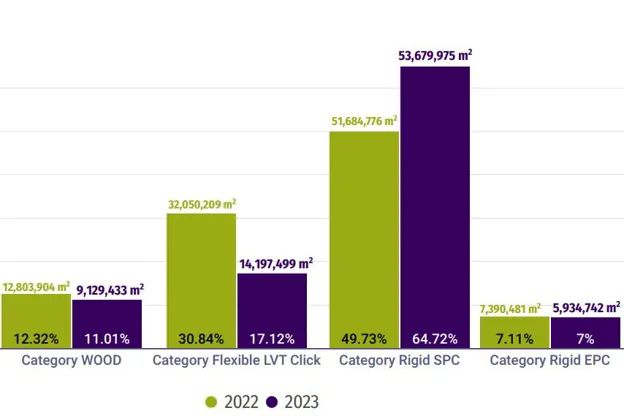

'Global sales figures from MMFA members reveal that we are not immune to the overall downturn in the construction sector, showing a -20% decline across all categories compared to 2022. SPC still exhibits exceptional growth (at 3.9%), reaching a total market share of 65% compared to other MMF categories. The "wood" category suffered the most last year, resulting in a revenue decline of nearly -28.7% compared to 2022. For polymer products, the loss amounts to -19% of total revenue. Despite a downward trend following last year, quarters vary, with many regions experiencing a revival towards the end of the month.'

Shift in market share

The decline in the wood category was widespread, with a global revenue decline of -28.7% and sales of 9.1 million m². Similarly, sales of polymer products fell by -19% with sales of 73.8 million m² in 2023. SPC products see their market share increase over the years, at the expense of LVT products and, to a lesser extent, wood. The market share of EPC remains stable.

LVT click suffered the most as a category with a decline of -55.7% (sales of 14.2 million m²). MMFA members sold 5.9 million m² of EPC products, which amounts to a decline of -19.7%. For the best-performing category, finally, the sales volume of SPC products increased by +3.9% over the past year to a total sale of 53.7 million m².

Consistency across regions

Despite the general decline in sales of polymer products, the largest markets remain the same compared to 2022. The Western Europe region leads in volume with sales of 43.6 million m², a decrease of -12% compared to 2022. The SPC category is the most successful in Europe, representing sales of 34 million m² in 2023, followed by LVT click (with sales of 11.8 million m²) and EPC (with sales of 4.6 million m²).

The US follows again with sales of 18.7 million m², which represents a decrease of -38.4% compared to the sales figures of 2022. In terms of growth, Asia experienced a substantial increase of +52.5% (2.3 million m²) in 2023, while Latin America lagged behind (+10.9%). France (sales of 12.5 million m2) narrowly beats Germany (sales of 11.5 million m2) as the countries where MMF sales are most successful, reversing the top two from last year.

In Europe itself, there is a visible divide, with Eastern Europe showing an increase of +26.2%, led by soaring sales in Poland (2.5 million m2) and the Czech Republic (1.4 million m2, almost double that of 2022).

While the wood category performs well in North America (135,190 m², +18.26%), the biggest losses were recorded across Europe (-28.8% in the West and -34.3% in the East).

Changes among market champions

For all polymer products, the US remained the largest market for MMFA members worldwide in 2023, although a decrease of -38.4% was recorded compared to 2022. While some countries like Austria (+8.3%), Denmark (+21.8), Italy (+26.2%), and Poland (+34.5%) show solid growth, other larger markets, including Germany (- 24%) and France (-4.8%), exhibit a downward trend. It's worth noting that Norway is slowly approaching the 1 million m² mark with an increase of 25%.

As for the sales of LVT click, France remains the largest market of MMFA members for flexible LVT click products in Western Europe, with sales of 4.5 million m² despite a decrease in sales volume by 24.6%. This is followed by Germany with 2.2 million m² (-55.4%) and Great Britain (1.1 million m²; -54.5%). Although the market in North America took a major hit, it remains the largest with sales of 1.5 million m² (-85.7%) LVT click products in 2023. While the decline in market share of LVT benefited SPC products, their stable sales growth could not offset the decline of the flexible click market.

For wood products, Germany and Austria account for about 78% of the total revenue, however, there was a decline in revenue in Germany (-28.25%) and Austria (-27.44%). Besides the two largest markets for MMFA, Switzerland (359,164 m²; -15.82%) took over the third place from Denmark (266,927 m²; -38.5%) compared to 2022. In Eastern Europe, the Czech Republic remained the largest market, with sales of 269,910 m² (-34.72%).

Anticipating

While overall sales figures reflect the level of 2019, the differences between each quarter of 2023 show that recovery and progress do not necessarily proceed linearly. Ongoing global disruptions such as the war in Ukraine, the Middle East, and tensions in the Red Sea – as well as the associated costs of logistics and raw materials – continue to exert their effects on various industries, and the MMF sector is no exception. While it may be difficult to predict the future of MMFA member sales figures for the coming year, the upward curve observed in the last quarter of the year across all regions and categories provides room for the expectation that the market will quickly stabilize.

About MMFA: Multilayer Modular Flooring Association is an organization that represents leading flooring manufacturers in Europe and their suppliers. The association was founded in October 2012 in Munich, Germany, by seven European flooring manufacturers. It is now led from Brussels.