Since 2008, the furniture retail landscape has been rapidly evolving, driven by digital innovation and changing consumer expectations. HomeByMe's research of 24,000 consumers, combined with surveys from IPEA and Catalyse Research, highlights key differences between European and American furniture shoppers and provides actionable insights for retailers seeking to succeed in both markets.

© Marie-Elise Bruins Slot | InteriorDaily.com

© Marie-Elise Bruins Slot | InteriorDaily.com

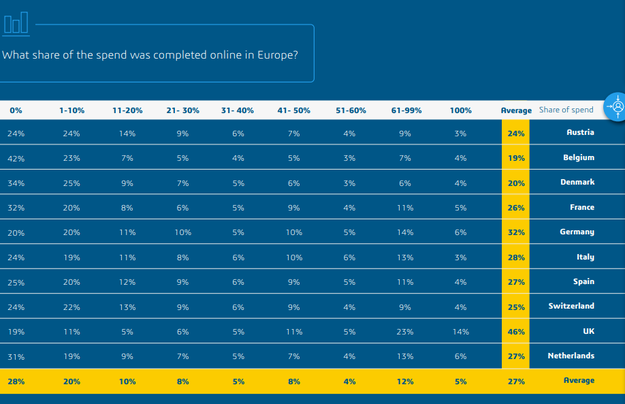

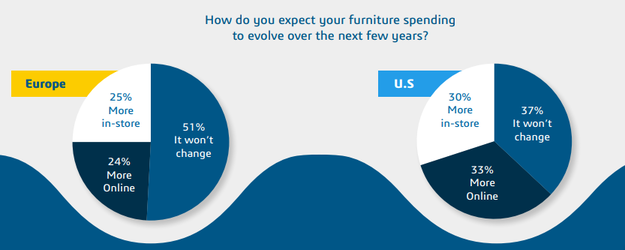

Digital and Omnichannel Behavior

Consumers increasingly expect hybrid shopping experiences that blend online inspiration with in-store validation. U.S. shoppers are more digitally confident at every stage of the journey, with 43% of furniture spending happening online, compared to 21% in Europe. Europeans, while digitally active, 80% start their journey online, tend to switch to in-store channels for reassurance before making purchases. The path to purchase typically includes three phases: inspiration, in-store validation, and final purchase, though the emphasis on each phase differs by region.

© Marie-Elise Bruins Slot | InteriorDaily.com

© Marie-Elise Bruins Slot | InteriorDaily.com

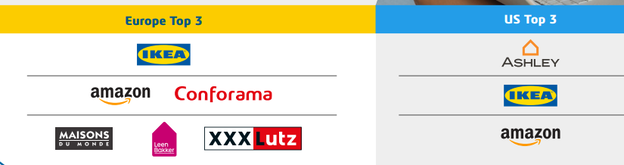

Market and Brand Preferences

In Europe, local and specialist retailers remain influential, particularly for higher-consideration purchases where advice and proximity matter. By contrast, the U.S. market favors large generalist retailers offering breadth, speed, and one-stop solutions. Brand popularity is strong across both markets, particularly among younger consumers, with Ikea and Amazon appearing in the top three in both regions. Motivations also differ: American shoppers often purchase due to moves, prompting full-room updates, while European purchases are more value-driven and cautious.

© Marie-Elise Bruins Slot | InteriorDaily.com

© Marie-Elise Bruins Slot | InteriorDaily.com

Technology and Innovation

AI, 3D configurators, and planning tools are transforming furniture retail. In the U.S., 22% of consumers have used AI to visualize design possibilities, and 97% report satisfaction. Europe is catching up, with a growing share of consumers using AI for furniture and kitchen purchases. Kitchens, in particular, act as a testing ground for digital design adoption, with in-store configurator use prevalent in both regions.

Notably, for kitchen purchases, 66% are bought in physical stores in Europe compared to 17% online, whereas in the U.S., 44% are purchased in-store and 31% online. The average kitchen spend in the U.S. was $13,393 in 2025.

Human expertise remains key

Even as digital tools grow, consumers continue to seek in-person guidance. In Europe, 65% want access to configurators in-store, while in the U.S., 80% consult sales associates during visits. Retailers that combine technology with expert advice, positioning staff as "design partners", can increase consumer confidence, accelerate decision-making, and personalize the shopping journey.

While kitchens lead the way in digital adoption, the desire for personalization extends throughout the home. Consumers increasingly expect the same visualization and customization capabilities across living spaces, especially those who have already used design solutions in other contexts.

© Marie-Elise Bruins Slot | InteriorDaily.com

© Marie-Elise Bruins Slot | InteriorDaily.com

Implications for Retailers

European retailers can learn from U.S. best practices by:

-Localizing omnichannel experiences to match cultural and market expectations.

Integrating AI, 3D planners, and configurators into the in-store and online experience.

-Empowering sales staff to guide customers through a hybrid, digitally supported journey.

-Balancing inspiration online with reassurance and expertise in-store.

-The research underscores that no single approach dominates: the most successful retailers will provide seamless integration across digital and physical channels, use technology to enhance human interactions, and adapt strategies to local consumer behaviors.

About HomeByMe

HomeByMe provides retailers with 3D planning and configurator tools to connect digital inspiration with in-store collaboration, enabling consumers to design, personalize, and visualize their spaces while supporting expert-guided decisions at every stage of the journey.