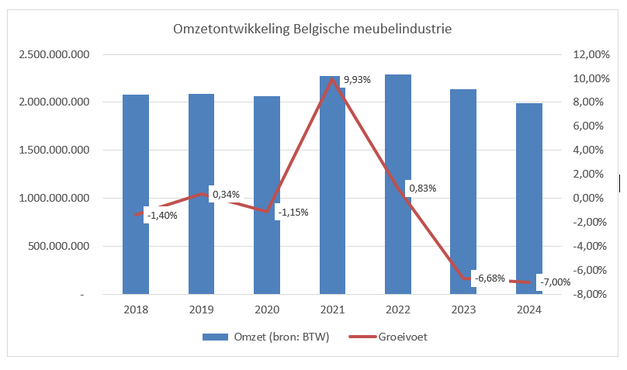

The Belgian furniture industry experienced another difficult year in 2024.

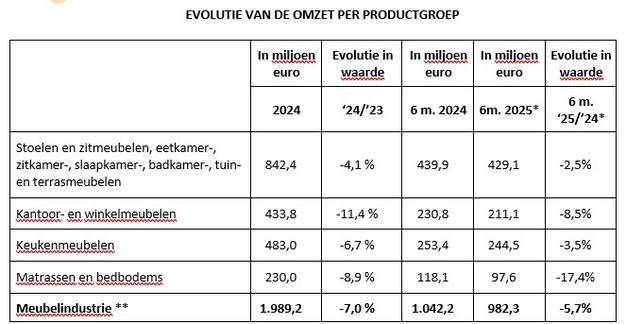

For the second year in a row, sales fell sharply, by around -7%, bringing total sector sales to just under €2 billion. The tide remained unfavourable in the first half of 2025 as well. Turnover fell again, reaching 5.7% lower than in the first half of 2024.

© Vadym Andrushchenko | Dreamstime

© Vadym Andrushchenko | Dreamstime

This continued contraction confirms that the sector is still under pressure, both from previously weak demand in the construction sector and cautious consumer spending.

The downturn was felt across all product groups. No segment was able to break the downward trend. Office and shop furniture (-8.5%) and mattresses and bed bases (-17.4%) were hit hardest. Residential furniture experienced a 2.5% drop in sales and kitchen furniture sales declined by 3.5%.

In the absence of reliable data on sales prices, it is not possible to estimate the evolution of sales in volume terms.

According to the production index, production volume fell by 2.1% in the first half of 2025 compared to the same period in 2024.

© Fedustria

© Fedustria

© Fedustria

© Fedustria

Furniture exports and imports fell

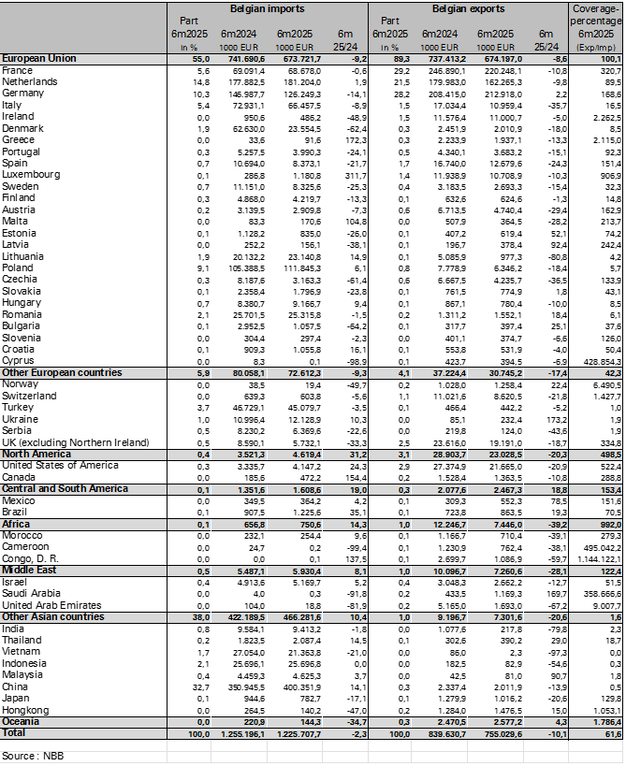

Belgian furniture exports (including transit) fell by 1.5% in 2024 and dropped sharply further by -10.1% in the first half of 2025 compared to the same period a year earlier. About 89% of exports go to the EU market, where deliveries were down 8.6%.

Within the EU, the main export markets evolved differently. Sales to France, the main export market with a 29.2% share, fell by 10.8%. In the German market, the second most important export market (28.2% share), sales were up 2.2%. Furniture exports to the Netherlands ranked third with a 21.5% share and, after an 11.6% decline in 2024, declined further by 9.8% during the first half of 2025.

Outside the EU, the United States remained the largest export market (2.9% market share). In 2024, exports there rose by 15.3%, but a sharp 20.9% decline followed in the first half of 2025, partly due to higher import duties. The UK (2.5% market share) also experienced a decline of about -18%, after another rise of about 12% in 2024.

Furniture imports rose 3.6% in 2024, but fell 2.3% in the first half of 2025. After two years of decline, imports from China rose 21.2% in 2024. Another solid growth of 14.1% followed in the first half of 2025. China, with a 32.7% share, remains the most important and very dominant supplier of furniture in our market. Dutch furniture imports (14.8% share) rose slightly (+1.9%), while German imports (10.3% share) fell by 14.1%. Poland, the fourth most important supplier with a 9.1% share, delivered 6.1% more to our market.

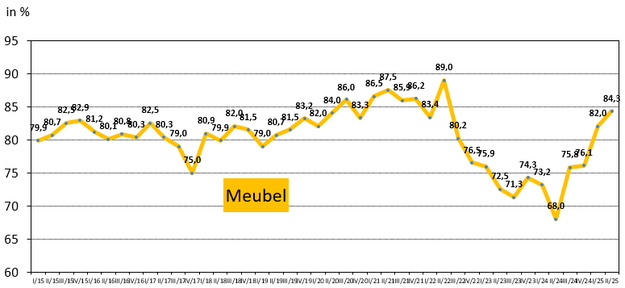

Capacity utilisation rate recovers and willingness to invest remains uncertain

The capacity utilisation rate in the Belgian furniture industry fell to an average of 73% in 2023 and 2024, the lowest level in a decade. In the first six months of 2025, capacity utilisation climbed above 80% again, to 83.2%, bringing the sector back to normal levels.

Whether this higher occupancy rate translates into more investment is still unclear. In the first half of 2025, investment continued to fall by 2.4%, following a sharp decline of 16.7% in 2024.

© Fedustria

© Fedustria

Employment fell again

In 2024, 8,739 workers were employed in the furniture industry. Compared to 2023, this is a decline of 820 workers or -8.6%. In the first quarter of 2025, employment fell further: -4.9% compared to the same period 2024.

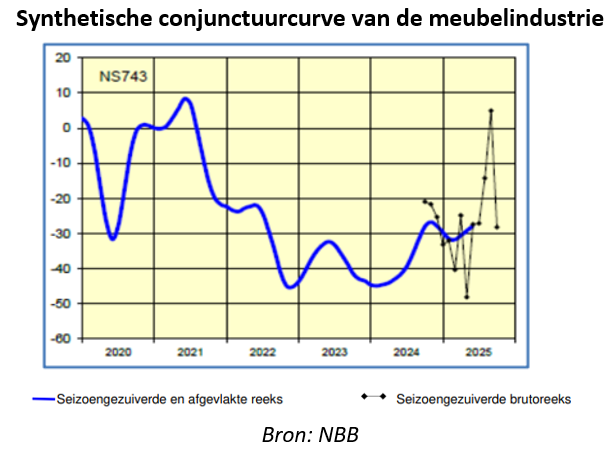

Business confidence picked up sharply, followed by sharp decline  © Fedustria

© Fedustria

The furniture industry's business cycle curve - a key measure of business confidence that is on average three months ahead of real economic activity - rose dramatically in the May-August 2025 period. For the first time in a long time, the curve rose above zero, meaning that more business leaders are optimistic than pessimistic about the future evolution of the sector. However, a sharp decline followed in September 2025.

© Fedustria

© Fedustria

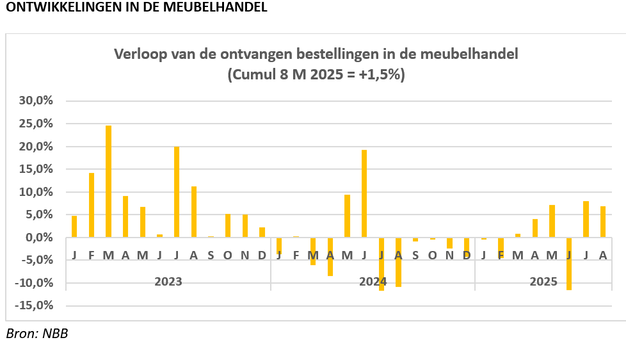

The level of orders in the furniture trade in 2025 remains rather low, although since the summer months a turnaround seems to be in place, with growth figures in July and August after a weak June. Cumulatively for the first eight months, orders were 1.5% higher than in 2024.

Outlook for 2025: moderately positive but uncertain

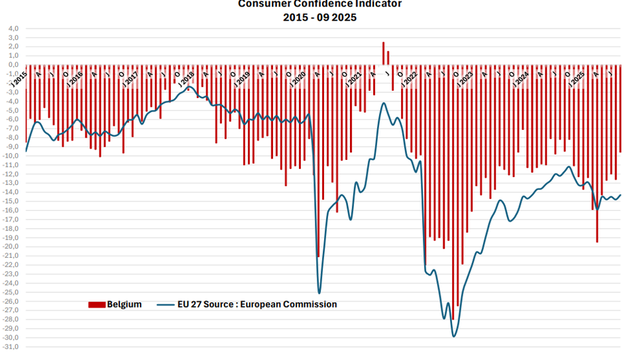

Consumer confidence recovers

After an all-time low in mid-2022 due to the energy crisis, Belgian and European consumer confidence recovered in 2023 and 2024. From the end of 2024 onwards, the mood flipped again and Belgian and European consumers became more pessimistic, but since May 2025 an upward trend is again noticeable.

© Fedustria

© Fedustria

A further improvement in consumer confidence could have a positive impact on domestic furniture demand in 2025, although growth in residential investment remains negative.

International trade: source of uncertainty

US trade measures have a general inhibiting effect on the global economy. The trade agreement concluded between the US and the EU limits tariffs on products of European origin to 15%. Exporters from other countries are subjected to higher tariffs which could provide a competitive advantage in the US market for Belgian products.

On the other hand, there is a risk that products subject to high tariffs could be diverted to the EU market, increasing competitive pressure. Fedustria therefore calls for the necessary market surveillance to avoid unfair trade practices such as dumping and also to ensure that imported products meet the standards applicable in Europe.

Economic outlook eurozone and Belgium

Despite trade tensions, the Planning Bureau expects slight economic growth in the euro area at 0.9% in 2024 to 1.3% in 2025 and 1.4% in 2026, boosted by fiscal measures and monetary policy easing.

Growth in the Belgian economy is expected to remain relatively stable from 1.0% in 2024 to 1.2% in 2025 and 1.1% in 2026. For 2025, growth is mainly driven by private consumption and business investment. In addition, government consumption and investment continue to rise sharply, mainly due to higher defence spending.

© Fedustria

© Fedustria

Afterword

The prolonged period of downturn combined with geopolitical factors that are difficult to predict do not deter furniture companies from remaining committed to innovation, sustainability and circularity.

World-class top design

The state-of-the-art products of our Belgian furniture companies are appreciated worldwide for their creativity, quality and customised service. Under the banner of 'Belgian Furniture powered by Fedustria', (collective) stands are set up at furniture and interior design fairs such as Milan, Index Dubai or Maison & Objet.

The fact that Belgian furniture design (both indoor and outdoor) is of world class was recently demonstrated once again during the Belgian Economic Mission to the United States. There, Belgian furniture design was put in the spotlight and a Memorandum of Understanding (MoU) was signed with the TBS Design Gallery in San Francisco. This strategic partnership aims to strengthen the presence and visibility of Belgian design in California and promote sustainable transatlantic cooperation within the design world.

Starting in 2026, Fedustria and its member companies will launch the Belgian Design Days in California. This event invites architects, designers and clients to experience the creativity, craftsmanship and innovation of Belgian design up close at the TBS Gallery showroom.

Besides San Francisco, Fedustria is also developing new opportunities in Los Angeles, with the support of Flanders Investment & Trade (FIT) and the Belgian diplomatic representation. Plans are in the pipeline for a pop-up presentation.

Forerunners in sustainability and circularity

Partly in the light of legislative initiatives, such as the extended producer responsibility, efforts are being intensified on e.g. ecodesign and "design for disassembly", which enables reuse and recycling of materials and raw materials. A forerunner to this is undoubtedly the mattress sector, where circular solutions are increasingly being offered on the market. Belgian manufacturers are taking a leading role here and often serve as an example to their European colleagues. Several new business models are also emerging: repair, reuse and rental of furniture.

The challenge now is to also raise consumer awareness of these circular and ecologically responsible solutions and products.

Normally, the European Union Deforestation Regulation (EUDR) will come into force on 30 December 2025 after a one-year delay. Recently, the European Commission submitted a proposal to further simplify and adapt this regulation to start reducing the administrative burden. However, this proposal does not immediately provide much-needed clarification and it remains uncertain that it will gain the necessary political support.

Talent wanted

With initiatives such as the trend platform watf.news (Woodcrafts and Textile Futures) and the STEAM tool TWIINZ.WORLD, rolled out in cooperation with youth marketing agency Trendwolves, Fedustria aims to introduce and direct young talent to the furniture sector. Through TWIINZ.WORLD, 10- to 14-year-olds can get creative in a virtual world with 3D products from

Fedustria member companies to create their own dream world (e.g. dream bedroom, dream classroom, dream garden).

Choosing wooden furniture is healthy!

Recent neuroscientific research led by Prof Dr Steven Laureys shows that wood has a positive impact on our well-being: it reduces stress, contributes to positive emotions, enhances emotional intelligence and engagement. Whether at home, the office, school or hospital, wood creates a warm and comforting atmosphere. Choosing wooden furniture is therefore positive for our well-being. Find out more about the study: https://houtdenatuurlijkekeuze.be/ons-brein-houdt-van-hout/

Wide range

Belgian furniture manufacturers offer something for everyone: be it furniture in kit, compact furniture, grand arrangements, from minimalist sleek design to spacious designs, from mid to high-end. At the Brussels Furniture Fair, one gets a great overview of what the Belgian furniture industry has to offer. Definitely worth a visit!

The key figures (2024) Belgian furniture industry

- 667 companies

- 8,739 employees

- Turnover: 2 billion euro

- Evolution of activity by value: -7%

- Export share: 57%

- Share in total turnover of the Belgian wood and furniture industry: 33%

Summary developments in the first half of 2025

- Turnover: €982 million, -5.7% compared to first half 2024

- Investment: -2.4% in first half 2025; €38.4 million

- Capacity utilisation: 83.2%

- Exports: -10.1% compared to the same period in 2024. France remains the largest

- sales market

- Imports: -2.3% compared to the same period in 2024

More information:

Fedustria

www.fedustria.be