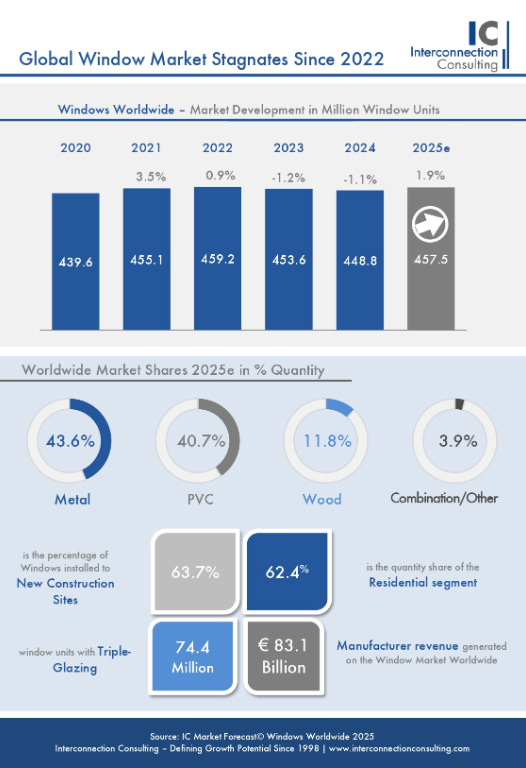

After a challenging year for the construction industry, the global window market is showing the first signs of recovery. In 2024, total market volume reached 448.8 million window units, a decline of 1.1%, while manufacturers' revenues fell by 1.7% to €81.1 billion. The outlook for 2025 is cautiously optimistic, with market volume expected to grow by 1.9% to 457.5 million units, though still slightly below 2022 levels, according to a study by Interconnection Consulting.

© Svetlana Larina | Dreamstime

© Svetlana Larina | Dreamstime

High interest rates and geopolitical tensions slow recovery

Global recovery remains muted, constrained by elevated construction financing costs, geopolitical uncertainty, and U.S. trade policies. Central and Eastern Europe (CEE) saw market volumes drop 6.2% in 2024 to 13.4 million units, with Poland (–8.6%) and the Czech–Slovakia region (–8.0%) the hardest hit. Western Europe faced similar challenges, with declines of 8.0% in 2023 and 6.0% in 2024. By contrast, the U.S. and Canadian markets grew by 2.9% in 2024, though growth is expected to slow in 2025.

Asia on the rise

Asian markets recorded robust growth, particularly India (+6.2%) and Southeast Asia (+5.9%), driven by urbanisation, rising incomes, and government housing initiatives such as India's Pradhan Mantri Awas Yojana (PMAY). China's market stagnated due to declining home prices, high developer debt, and stricter borrowing regulations, though an interest rate cut in January 2025 is expected to stimulate construction later in the year.

Metal and PVC lead the market

Metal windows remain the largest segment, with 194.4 million units, followed by PVC windows at 182.7 million units. Wooden windows accounted for 54.3 million units, while hybrid and other types (e.g., fibreglass) totalled 17.4 million. Metal windows slightly increased market share due to strong non-residential construction, particularly in Asia, while PVC-dominated regions saw slower growth.

Outlook

While challenges remain, early recovery signs and strong growth in Asia suggest cautious optimism for 2025. Manufacturers and investors should monitor regional dynamics, material trends, and macroeconomic factors closely to capitalise on emerging opportunities.

© Interconnection Consulting

© Interconnection Consulting

More information:

Inter Connection Consulting

[email protected]

www.interconnectionconsulting.com