The European technology sector struggles with scaling potential winners due to a lack of growth capital. Nevertheless, the continent boasts a wide array of innovative players. In the Netherlands, for example, nearly two-thirds of investments in young software companies go to parties applying artificial intelligence.

© BiancoBlue | Dreamstime

© BiancoBlue | Dreamstime

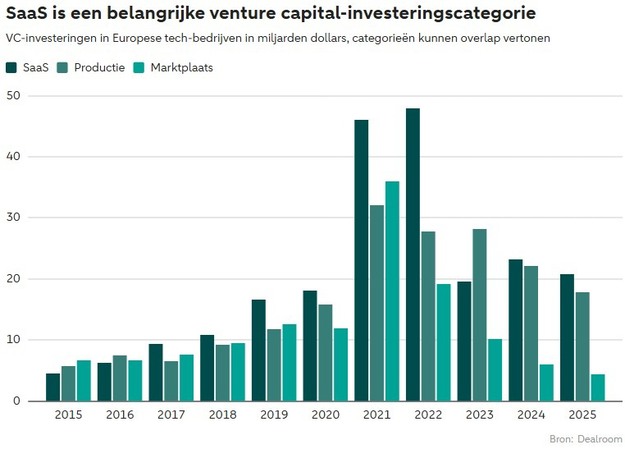

In 2024, young European technology companies collectively raised about 54 billion dollars in venture capital. Almost half of that, over 23 billion, flowed to Software-as-a-Service (SaaS). SaaS is thus the largest category, bigger than digital marketplaces or companies developing physical technology. For investors, the combination of stable subscriptions and scalability is particularly attractive.

© ABN AMRO

© ABN AMRO

During the coronavirus pandemic, ample capital flowed to technology, aided by low interest rates and investors' search for scalable business models. SaaS benefited disproportionately from this. From 2022, however, inflation kicked in, and central banks raised interest rates, making capital more expensive and correcting valuations. This made investors more cautious, especially with mega deals and loss-making growth companies. Venture capital investment volumes now seem to be stabilizing. SaaS thus remains the focal point of European tech financing, although within this category, capital is increasingly going to companies that have AI embedded at their core.

The scalability gap

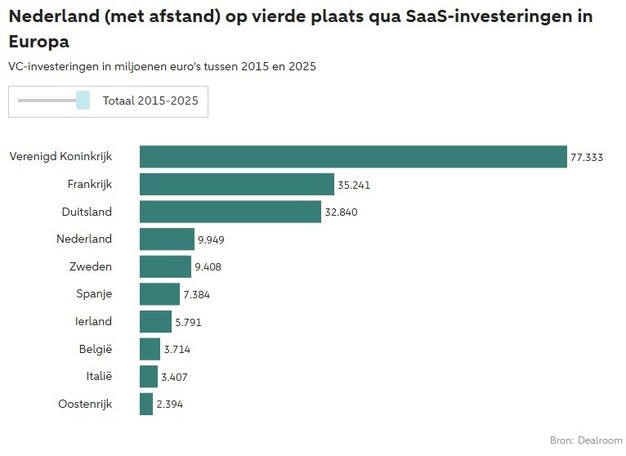

Within Europe, the United Kingdom attracts the most SaaS investments, with over 77 billion dollars in ten years, more than a third of the European total. France and Germany follow, with 35 billion dollars (16 percent) and 33 billion (15 percent), respectively. The Netherlands remains stable in fourth place at 9.9 billion, accounting for 4.5 percent of all European SaaS investments between 2015 and 2025.

© ABN AMRO

© ABN AMRO

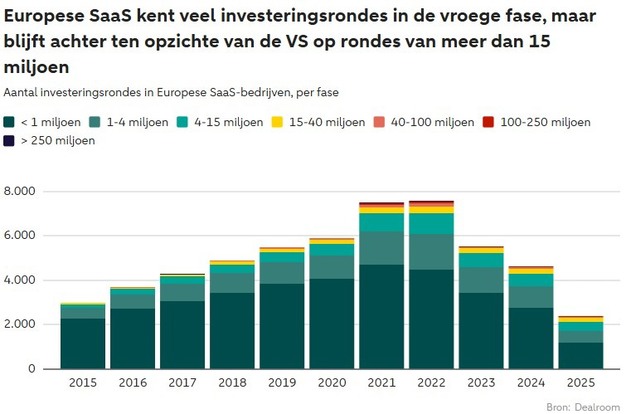

Unfortunately, Europe faces a persistent problem: the lack of capital for tech companies to grow into internationally competitive companies. U.S. startups are twice as likely to raise a round of more than 15 million dollars as their European counterparts, according to the 2024 State of European Tech report. As a result, the share of young companies advancing to the scale-up phase is much smaller in Europe. According to the researchers, the cumulative deficit now amounts to 375 billion dollars, the total amount young tech companies would have raised over the past decade if access to larger investments were as easy as in the United States (U.S.). In the U.S., a large portion of the money even goes to rounds over 100 million dollars, with a dominant role for mega deals over 250 million. Although not even so many fewer SaaS deals are closed in Europe, 4616 compared to 5040 in the U.S. in the past year, the focus remains on smaller rounds.

© ABN AMRO

© ABN AMRO

Broadly applicable SaaS niches

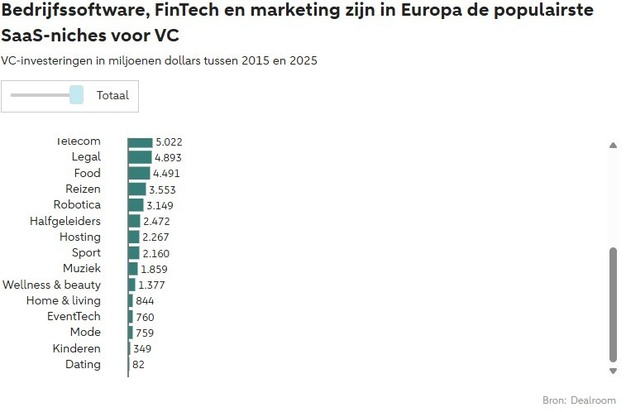

Venture capital in Europe mainly flows to several recognizable SaaS niches. The largest category is 'enterprise software' – solutions that make internal organizational processes more efficient, from HR and planning systems to workflow and ERP tools. For example, the German unicorn Personio further strengthened its position in HR software, while its compatriot N8N specializes in process automation.

Additionally, there are other solutions applicable in virtually every sector. Marketing and communication software remain popular, with marketing platform Brevo as an example. Skeepers helps brands cleverly incorporate customer reviews and other 'user-generated content' into campaigns. Cybersecurity also benefits from broad applicability, combined with a general sense of urgency now that cyberattacks are becoming increasingly sophisticated. For example, French Sekoia.io raised growth capital in 2024 for its AI platform that detects threats in real-time.

© ABN AMRO

© ABN AMRO

SaaS for specific sectors

In the FinTech realm, SaaS companies also attract a lot of funding. For example, British Volt.io offers a platform that allows companies to also accept payments from international customers, and Qover helps integrate insurance into a service offering across various sectors – from mobility to e-commerce. On the other hand, there are parties operating more specifically in the core of financial service providers, such as Backbase, which offers a customer platform for financial institutions to replace their old IT systems.

It's an example of one of the many 'vertical' SaaS services designed for a specific sector. In healthcare, Doctolib enters the broader European market with a platform that facilitates appointment management, consultations, and patient communication, while Unmind raised growth financing for a platform helping company employees improve their mental health. In hospitality, Dutch Mews raised new capital to roll out its platform internationally, and in construction and real estate, PlanRadar did so earlier with its project management software.

AI-SaaS as a new engine

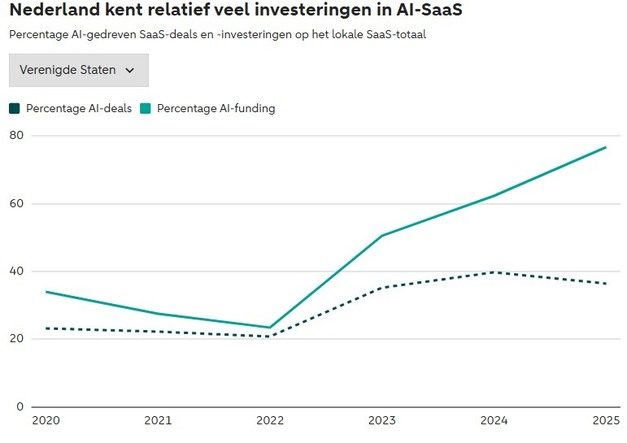

Within the broader landscape, AI-driven SaaS is taking up an increasingly larger place. In Europe, a third of software deals now fall into this category, accounting for nearly half of the investment volume. In the Netherlands, it's even two-thirds. The development is even faster in the U.S.; there, AI-SaaS gobbles up nearly 80 percent of all SaaS funding.

Nonetheless, Europe brings forth a lot of innovative, 'AI-first' SaaS companies specializing in various niches. The Netherlands even has an above-average number of AI-SaaS deals and funding. Cradle developed an AI model that can design new proteins and sells it as a SaaS service to laboratories. Compatriot Fourthline focuses on identity fraud and compliance in the financial sector with AI, and FRISS does the same for insurance risks. TestGorilla makes selection processes smarter and less prone to bias, and Sympower uses AI to balance electricity grids.

German Accure offers a platform for AI analysis of battery data in sectors including mobility and industry, to improve battery safety and lifespan. British Synthesia automates the production of corporate films and training videos with generative AI and raised another 180 million dollars in early 2025, at a valuation of over 2 billion. Meanwhile, Swedish Lovable is experiencing massive growth with a platform that uses AI to accelerate and make software development more accessible. Established in 2023, the company reached a valuation of nearly 2 billion dollars within a few years.

© ABN AMRO

© ABN AMRO

Major AI developers set the tone

A significant portion of investments is concentrated with a few major AI developers, setting the market tone with mega deals. Their AI systems are offered in two ways: as a building block for software developers to incorporate AI into their own product and in the form of chat apps like ChatGPT (OpenAI) and Claude (Anthropic) for end-users. Those who want access to the most powerful features pay a monthly subscription. Thus, the revenue model essentially matches SaaS: software offered via the cloud and for a periodic fee.

In the U.S., the respective mega deals led to substantial capital injections. OpenAI raised 40 billion dollars in March of this year at a valuation of 300 billion, followed by an additional round in the summer. Anthropic managed to raise another 13 billion dollars in September 2025, and xAI closed a 6 billion dollar round at the end of 2024. Europe has fewer such outliers, but here too, the AI-SaaS segment is rapidly growing. French Mistral AI raised 1.7 billion euros in a round in 2025, of which 1.3 billion came from ASML, doubling its valuation to nearly 12 billion. German Aleph Alpha received half a billion in previous rounds.

Success factors

Amid the growth surge of these major players, SaaS companies need to position themselves sharply. A key characteristic of promising providers is their focus on critical business processes, components of an organization that are simply crucial. Fourthline, for instance, automates the mandatory identification of customers in the financial sector. Banks must perform this process to comply with the law, and switching to another provider brings risks. FRISS does the same for insurers who have a significant interest in recognizing fraudulent claims. Doctolib supports doctors and patients with appointments and communication, an essential but often suboptimally digitized process.

Furthermore, opportunities lie in niches where large, but generic AI models cannot operate effectively. Cradle, which fully focuses on generative AI for protein design, for instance, is trained on an enormous database of protein structures and properties and combines deep knowledge in biology with technical capabilities. Sympower developed an AI solution that balances electricity grids, connecting both large consumers and energy producers. Collaboration with parties in energy-intensive industries such as agriculture, cement production, and data centers require strong relationships and a lot of domain knowledge that is not quickly copied.

Finally, it is striking that successful SaaS companies often form a connecting layer between multiple parties. N8N's automation platform, for instance, allows different software packages to 'talk' to each other, from CRM systems and email tools to databases and cloud services. This way, users can automate complex work processes across different applications. Qover offers a connecting layer in the insurance world; via APIs, the company enables insurance products to be directly embedded in, for example, mobility apps or e-commerce platforms. In both cases, it involves a software platform that allows others to enrich or optimize their own services.

The road ahead

The European SaaS market is brimming with innovation, but the path to global dominance is far from certain. The continent struggles with a structural scalability gap and a more cautious investment culture. However, encouraged by a geopolitical necessity to become more technologically self-sufficient, it takes various steps in the right direction. On September 23, 2025, Minister Karremans presented a list of measures to support "the tech champions of tomorrow," with an emphasis on research-intensive key technologies like cybersecurity, quantum computing, and artificial intelligence. For instance, the caretaker cabinet is investing 200 million euros in a second fund within the European Tech Champions Initiative (ETCI), and Invest-NL is exploring ways to channel more pension capital into venture capital funds.

The current generation of SaaS companies at least shows there are plenty of opportunities. Focusing on business-critical processes, AI applications in specific niches, and building a connecting layer are strategies with which local players can position themselves strongly, even amid the growth surge of U.S. parties. The success of Mistral at least proves that even capital-intensive models can gain traction here, provided there is sufficient willingness to invest. Now it is a matter of making these incidental successes structural.

More information:

ABN AMRO

www.abnamro.nl