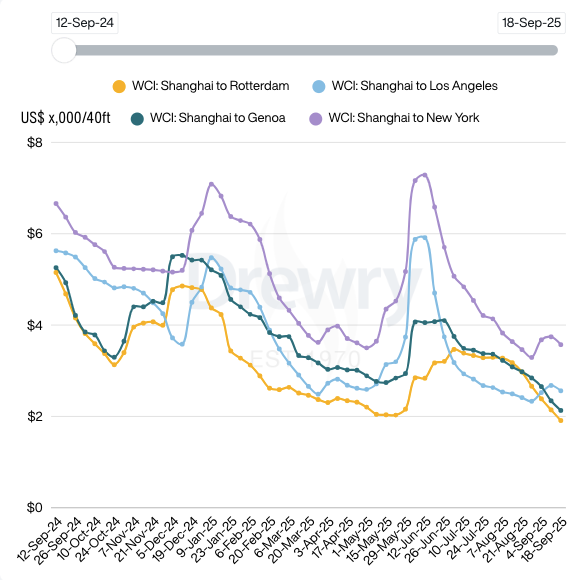

The Drewry World Container Index (WCI) recorded a further decline this week, falling 6% to $1,913 per 40ft container. This marks the 14th consecutive week of reductions, underlining continued weakness across major East–West trade routes.

© Mr.siwabud Veerapaisarn | Dreamstime

© Mr.siwabud Veerapaisarn | Dreamstime

According to Drewry, "the major trade routes, Transpacific and Asia–Europe, are now aligned in a downwards trajectory, although each is moving at a different pace."

On the Transpacific, rates from Shanghai to Los Angeles decreased 4% to $2,561 per 40ft, while Shanghai to New York fell 5% to $3,571 per 40ft. Drewry noted that "despite a brief uptick, the momentum from GRIs and blank sailings has now faded, which led to the reduction in rates."

On the Asia–Europe lanes, spot rates fell more sharply. "Rates declined 11% ($1,910/feu) on Shanghai–Rotterdam and 9% ($2,131/feu) on Shanghai–Genoa. This decline comes as carriers struggle to match increased capacity—due to new vessels entering the trade—with softening demand."

With China's Golden Week approaching on 1 October, Drewry expects blank sailings to increase and "rates continue to decline in the upcoming weeks."

Looking ahead, the consultancy warned: "Drewry's Container Forecaster expects the supply-demand balance to weaken again in 2H25, which will cause spot rates to contract. The volatility and timing of rate changes will depend on Trump's future tariffs and on capacity changes related to the introduction of US penalties on Chinese ships, which are uncertain."

© Drewry

© Drewry

More information;

Drewry

www.drewry.co.uk