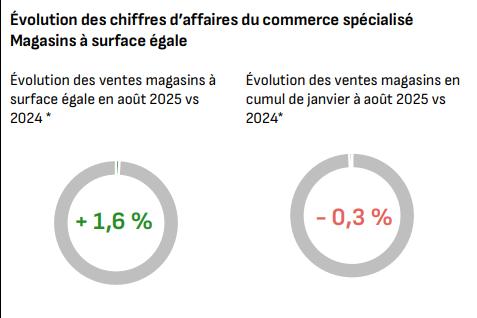

Store sales in the specialized retail sector in France showed signs of recovery in August 2025, following a significant decline in July. According to data from the PROCOS panel and the PROCOS/Stackr store footfall observatory, like-for-like store sales rose by 1.6% in August compared with the same month in 2024. Despite this positive rebound, the combined sales for July and August remain slightly below the levels recorded during the same period last year.

© Panel PROCOS

© Panel PROCOS

Sectoral performance varied significantly. Clothing sales demonstrated the strongest growth, increasing 3% year-on-year, while beauty and health products rose 2.9%, reflecting sustained consumer demand in these categories. Conversely, home equipment sales continued to contract slightly, down 0.2% compared with August 2024. The most marked decline was observed in the restaurant and catering sector, which fell 3.3%, affected by consumer budget adjustments during summer vacations.

Store footfall also declined 2.4% year-on-year. However, the data show notable regional differences, with foot traffic in Paris proving more dynamic than in other regions. Overall, these figures suggest that while consumer activity is recovering in some areas, it remains uneven across sectors and locations.

Cumulatively from January to August 2025, store sales are nearly flat compared with the same period in 2024, showing a slight decrease of 0.3%. When accounting for an inflation rate of 1.5% over the period, the real volume of sales has declined more substantially, highlighting ongoing pressures on consumer purchasing power despite nominal sales stability.

Looking ahead, retail chains are focused on the critical period of the year when preparations for end-of-year sales are underway. Short-term concerns include the potential impact of announced social movements on store accessibility and operations. Ensuring safe and stable conditions for store teams and customers is seen as essential to maintain sales momentum during this vital trading period.

© Dreamstime

© Dreamstime

Retailers also emphasize the importance of a stable and predictable political and regulatory environment, which is key to supporting investment and allowing businesses to adapt to the rapidly changing retail landscape. This includes the need to enforce compliance with French and European regulations on foreign e-commerce platforms, particularly those from Asia, which have seen significant growth in sales.

Another key priority is the adoption of the long-awaited simplification law, particularly measures enabling the monthly payment of rents, which is critical for cash flow management across all retail companies, regardless of size.

Data sources for this report include the PROCOS panel, which tracks store sales, the PROCOS/Stackr store footfall observatory, and Retail Int., which collects daily sales data from its 120 member chains, representing 15,000 stores and €25 billion in turnover. Retail Int. also benchmarks store performance against peers and provides models to estimate potential sales for new locations.

Overall, the report shows that while August 2025 marked a moderate recovery in specialized retail sales, challenges remain in certain sectors and regions. Retailers are focused on navigating these dynamics as they prepare for the high-stakes end-of-year trading season.

Source: www.procos.org