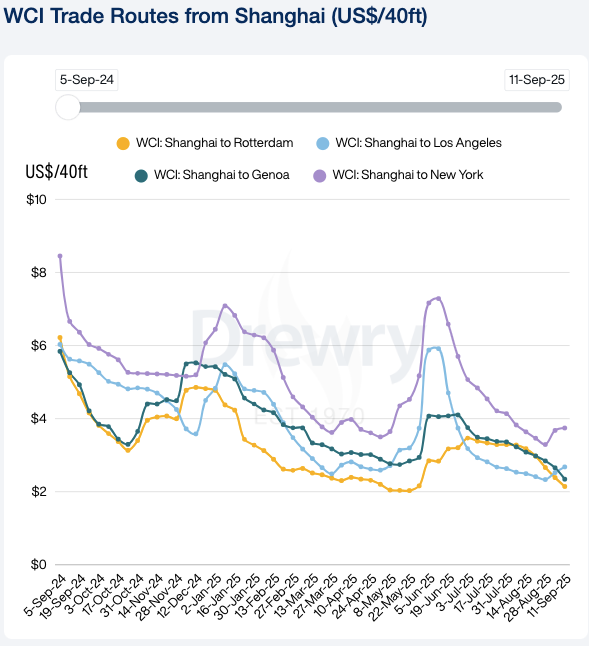

Drewry has reported a further 3% fall in its World Container Index (WCI), taking the benchmark rate to $2,044 per 40ft container, the 13th straight weekly decline.

© Lunamarina | Dreamstime

© Lunamarina | Dreamstime

While Transpacific spot rates rose on the back of general rate increases, Shanghai to Los Angeles up 6% to $2,678 per feu, and Shanghai to New York up 2% to $3,743 per feu, analysts caution the gains may prove short-lived without further capacity cuts, especially ahead of China's Golden Week.

In contrast, Asia–Europe rates dropped sharply: Shanghai to Rotterdam fell 10% to $2,143 per feu, and Shanghai to Genoa slid 12% to $2,342 per feu, as carriers struggled to balance new vessel supply with softening demand.

Drewry expects rates to remain under pressure in the weeks ahead. Its Container Forecaster signals a weaker supply, demand balance in the second half of 2025, with volatility influenced by US tariffs and potential penalties on Chinese shipping.

The WCI, regarded as an independent global reference for index-linked contracts, tracks spot freight rates across eight major East-West trades.

For further insights, Drewry's benchmarking and freight rate services provide visibility across 6,700 global port pairs, helping shippers and logistics providers navigate ongoing market uncertainty.

© Drewry

© Drewry

More information:

Drewry

www.drewry.co.uk