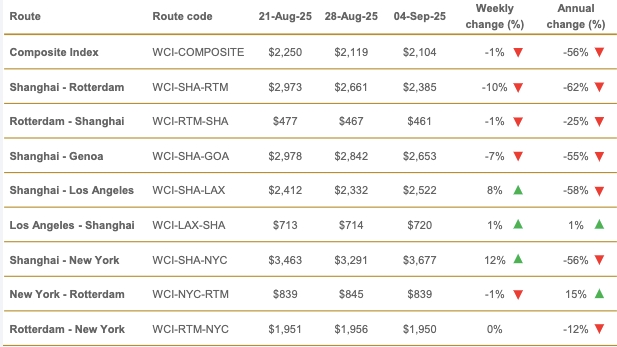

Drewry Supply Chain Advisors reports that the World Container Index (WCI) has stabilised this week at $2,104 per 40ft container, following 11 consecutive weeks of decline.

© Ilfede | Dreamstime

© Ilfede | Dreamstime

Drewry attributes the stability to opposing movements in key trade lanes. "After 11 weeks of decline, Drewry's World Container Index (WCI) stabilised this week. This stability is the result of opposing trends in different trade lanes. While a significant increase in Transpacific rates pushed the index up, a major drop in Asia–Europe rates counterbalanced this surge, resulting in a steady index overall," the consultancy explains.

Transpacific spot rates rose following General Rate Increase (GRI) announcements by several carriers. Rates from Shanghai to Los Angeles increased 8% to $2,522 per feu, while Shanghai to New York jumped 12% to $3,677 per feu. Despite the upcoming Golden Week holiday in China, Drewry notes that "it is unlikely that these rates will be sustainable without further cuts to shipping capacity. Hence, Drewry expects rates to remain stable in the upcoming weeks."

Conversely, Asia–Europe spot rates fell, with Shanghai–Rotterdam dropping 10% ($2,385/feu) and Shanghai–Genoa down 7% ($2,653/feu), reflecting a surplus of vessel capacity. Drewry anticipates further declines in this trade lane, stating that "the volatility and timing of rate changes will depend on Trump's future tariffs and on capacity changes related to the introduction of US penalties on Chinese ships, which are uncertain."

© Drewry

© Drewry

More information:

Drewry

www.drewry.co.uk