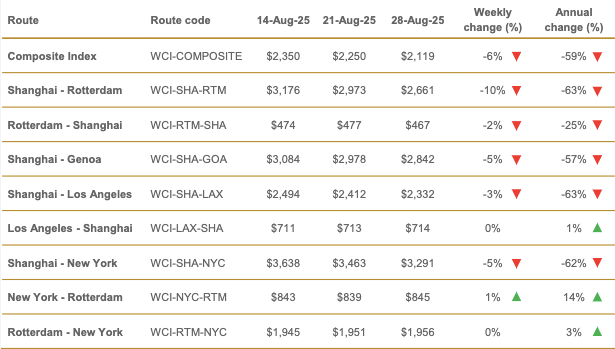

Drewry's World Container Index (WCI) recorded its 11th consecutive weekly decline, falling 6% to $2,119 per 40ft container. The index, a key global benchmark for spot freight rates, reflects continued market volatility triggered by shifting trade policies and excess vessel capacity.

© Enrique Gomez Tamez | Dreamstime

© Enrique Gomez Tamez | Dreamstime

'The unpredictability began after US tariffs were announced in April, which caused rates to surge from May through early June, but they plunged thereafter until mid-July and continued to decline till this week,' Drewry reported.

Transpacific spot rates also weakened, with Shanghai–Los Angeles falling 3% to $2,332 per FEU and Shanghai–New York down 5% to $3,291 per FEU. Drewry noted: 'The phase of accelerated purchasing by US retailers, which induced an early peak season, has ended. In response to a decelerating US economy and increased tariff costs, they are now scaling back on procurement but at a measured pace. Hence, Drewry expects rates on this trade lane to continue declining in the coming weeks.'

On the Asia–Europe trade, rates on Shanghai–Rotterdam dropped 10% to $2,661 per FEU and Shanghai–Genoa by 5% to $2,842 per FEU. Drewry explained: 'Despite healthy demand and port delays in Europe, a growing surplus of vessel capacity has been pushing down spot rates on this trade lane. Therefore, Drewry predicts a further decline in spot rates in the coming weeks.'

Looking ahead, Drewry's Container Forecaster warns the supply-demand balance will weaken in 2H25, with further contractions likely. The pace of change, however, remains dependent on future tariff policies and capacity adjustments.

© Drewry

© Drewry

More information:

Drewry

www.drewry.co.uk