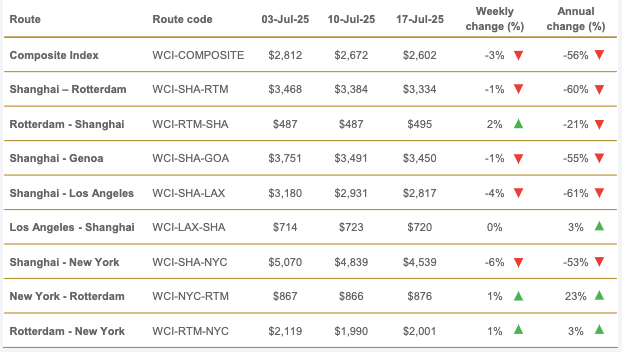

Drewry's World Container Index (WCI) has dropped for the fifth consecutive week, declining by 2.6% to $2,602 per 40ft container as of 17 July 2025. The fall signals a continued easing in the ocean freight market following a short-lived spike caused by US tariff hikes earlier this year.

© Mr.siwabud Veerapaisarn | Dreamstime

© Mr.siwabud Veerapaisarn | Dreamstime

The recent slide marks a reversal from the upward trend that began in May and peaked in early June, driven by delayed market reactions to tariffs announced in April. Rates on key transpacific routes are also down this week, with spot prices on Shanghai–Los Angeles falling 4% to $2,817 per FEU and Shanghai–New York decreasing 6% to $4,539 per FEU.

Despite the recent drops, rates remain elevated compared to pre-spike levels. Shanghai–Los Angeles is still 4% higher, and Shanghai–New York 24% higher than on 8 May.

Drewry expects further rate softening. "Drewry's Container Forecaster expects the supply-demand balance to weaken again in 2H25, which will cause spot rates to decline," the company reported. The pace and extent of future changes will depend on new US tariffs and potential penalties on Chinese vessels, which remain uncertain.

© Drewry

© Drewry

More information:

Drewry

www.drewry.co.uk