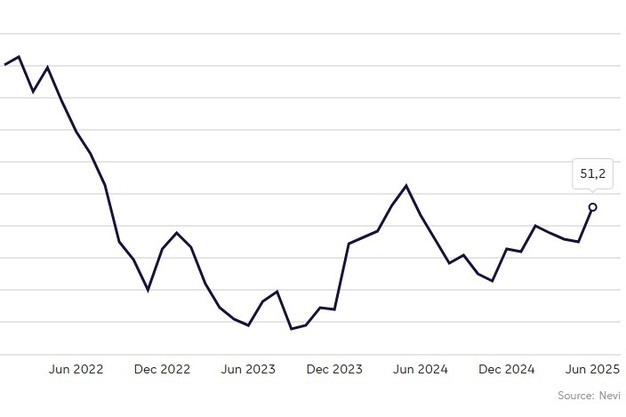

The Nevi Purchasing Managers' Index for the Dutch industry increased from 49.0 to 51.2 in June. For the first time in a year, the score is above 50, indicating growth in activity. Despite the trade war with the United States, the number of new orders is on the rise.

© Dreamstime

© Dreamstime

In addition to the number of new orders, production and employment also grew. Expectations for production over the next twelve months improved. Some respondents indicate optimism about new products and new investments.

Recovery of the German industry

The increase in the number of new orders, including export orders, may be explained by a cautious recovery of the German industry. Germany is the main export market for the Dutch industry. The Netherlands supplies parts for cars and machines, among other things.

Nevi Purchasing Managers' Index indicates growth in activity for the first time in a year © NEVI | ABN AMRO

© NEVI | ABN AMRO

The German industry could recover further thanks to the hundreds of billions that the new German coalition wants to spend on infrastructure and defence. Germany can also benefit from the new NATO spending standard of 3.5 percent of the gross domestic product on defence and another 1.5 percent on matters such as infrastructure. Germany has a leading defence industry. Moreover, investments in infrastructure such as roads and railways require many industrial products, such as steel and electrical components.

Growth for the ASML supply chain?

Another possible explanation for the improvement of the Nevi index could be the growth of the chip sector. Taiwanese market leader TSMC reported significant revenue growth over the first five months compared to the same period last year. It may be that the dip in the chip market of recent years is over, especially thanks to investments in advanced chips for the application of artificial intelligence (AI). TSMC is the main customer of chip machine manufacturer ASML from Veldhoven. If demand for chip machines were to increase significantly, many Dutch suppliers in Brabant and beyond could benefit. ASML will publish figures for the second quarter on Wednesday, July 16.

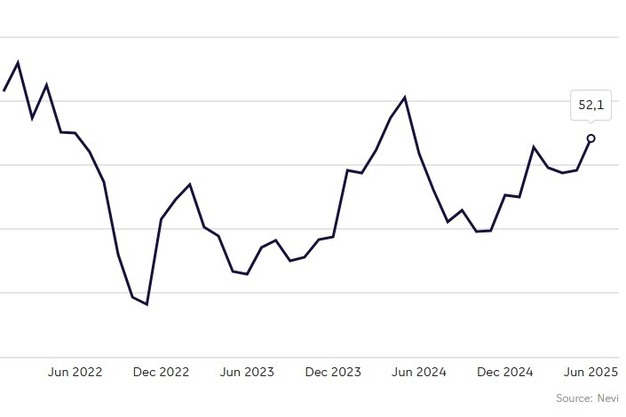

The number of new orders is rising again, according to a sub-indicator of the Nevi Purchasing Managers' Index © NEVI | ABN AMRO

© NEVI | ABN AMRO

Dutch Lower House eases industry policy

Besides the new NATO standard, the easing of Dutch industry policy is also a boost for the sector. In the Spring Note, the Schoof cabinet scrapped the plastic tax, which was to take effect in 2028. Moreover, a majority of the Dutch Lower House voted last week in favour of a CDA motion to abolish the Dutch CO2 tax. As a result, the Dutch tax climate for the industry becomes less strict and more in line with EU policy. Within the EU, many major greenhouse gas emitters already have to pay via the emissions trading system ETS.

However, the energy-intensive industry continues to face other major obstacles, such as grid congestion and high energy prices in Europe, mainly due to dependence on imported natural gas in the form of LNG. Gas prices rose sharply in June due to escalating tensions between Israel and Iran and the military involvement of the United States, after which Iran threatened to close the Strait of Hormuz. If tankers have to avoid this strait, about 20 percent of global LNG trade could come to a standstill. In response to the bombings and shootings, gas prices rose by about 20 percent, but after the ceasefire between Israel and Iran, the market calmed down again.

More information:

Abn Amro

www.abnamro.nl